The Total Economic Impact™ Of Sage Intacct

Key Components for Achieving Financial Transformation

October 6, 2023

Why Sage Intacct is the Best Alternative to Microsoft Dynamics GP for Nonprofits

October 27, 2023Sage Intacct commissioned Forrester Consulting to conduct a Total Economic Impact™ (TEI) study and examine the potential return on investment (ROI) enterprises may realise by deploying Sage Intacct.

The purpose of this study is to provide readers with a framework to evaluate the potential financial impact of Sage Intacct on their organisations. To better understand the benefits, costs, and risks associated with this investment, Forrester interviewed four customers with experience using Sage Intacct. For the purposes of this study, Forrester aggregated the interviewees’ experiences and combined the results into a single composite organisation, a technology services company, headquartered in North America with global operations. The composite generates $30 million in annual revenue, has 100 employees, and grows 20% annually via acquisitions during the three-year TEI analysis period. Prior to Sage Intacct, the organisations’ accounting and financial systems were disjointed, complex, and problematic. The financial processes resided across multiple platforms, such as enterprise legacy systems, bookkeeping software, spreadsheets, and other applications. Due to lack of system consolidation and automation, the organisations used laborious manual processes to bridge data gaps, often requiring additional manpower to perform maintenance tasks, such as replicating the data in prior legacy and third-party software solutions or tracking contracts and invoices in individual spreadsheets. Lack of system integration created misrepresentation and blind spots for executives and auditors due to incorrect or missing data.

Furthermore, leadership lacked data accuracy and visibility required to make financial decisions and address issues in a timely manner. After the investment in Sage Intacct, the interviewees

acquired visibility into their organisations’ financial performance and had confidence in their numbers due to the platform’s real-time data. They gained financial insights and the ability to slice and dice the data, drill down on numbers, and isolate any issues with a particular number, which they could not do in their previous environments.

In addition, the interviewees were able to purchase the basic OOTB solution and add components as needed. This provided them with the flexibility to customise their financial software according to their reporting and audit requirements without tying up financial resources necessary for their growth.

KEY FINDINGS

Quantified benefits. Three-year risk-adjusted present value (PV) quantified benefits for the composite organization include:

• Incremental margin gained due to more accurate customer invoicing.

• Avoided/delayed cost of hires due to improved system automation and data accuracy.

• Incremental improvement in sales team effectiveness.

• Increased productivity of the accounting team and improved reporting compliance.

• Improved finance team efficiency and cost savings in audit reporting.

Unquantified benefits. Benefits that provide value for the composite organization but are not quantified in this study include:

• Improved visibility and reporting in real time that helps analyze data and isolate issues with numbers, locations, or products quickly.

• Access to customer accounts that does not require access to Sage Intacct due to real-time data integration with third-party CRM.

• The multi-entity function that effectively captures acquisitions and reports on company performance.

• Accounts payable and automated clearing house (ACH) transfers managed easily and securely.

• Increased visibility into nationwide operations at the local level that provides a unique perspective.

Costs. Three-year risk-adjusted PV costs for the composite organization include:

• The annual software costs: $119,000 over three years.

• Implementation costs, initial and ongoing: $263,000 over three years.

• Training costs: $5,000 over three years.

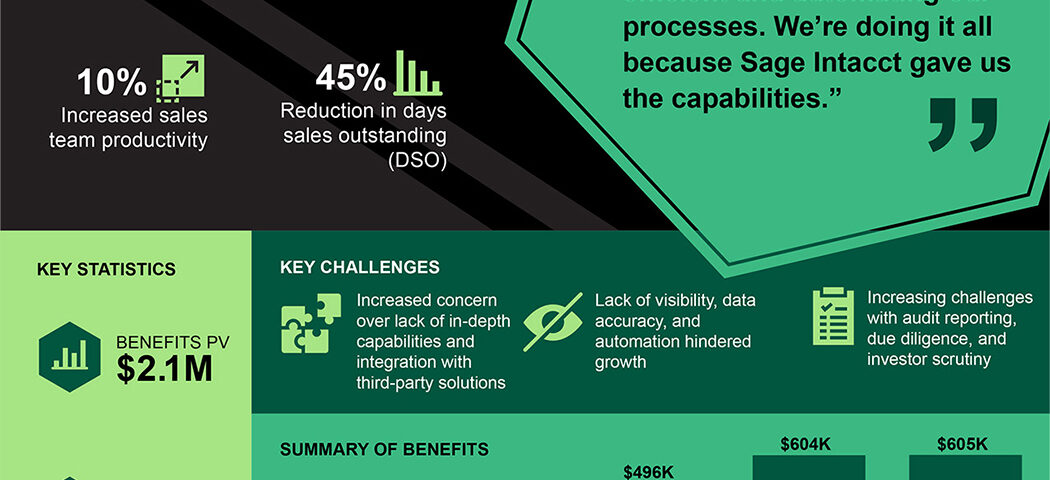

The representative interviews and financial analysis found that a composite organization experiences benefits of $2.1 million over three years versus costs of $387,000, adding up to a net present value (NPV) of $1.7 million and an ROI of 441%.

KEY CHALLENGES

Prior to Sage Intacct, the interviewees’ organisations lacked data accuracy, depth, and visibility into their organisations’ financial health and performance. Some used a comprehensive enterprise legacy solution that was a closed, very rigid, and expensive system lacking the customised flexibility and support that they needed to function. Others used a bookkeeping software that led to very manual and laborious processes of contract management, accounts payables, financial analysis, and reporting.

Furthermore, their prior enterprise resource planning (ERP) solutions did not integrate well with their other third-party solutions. The data was siloed and housed on multiple platforms and spreadsheets, leading to duplication, gaps, misrepresentation, and the inability to close the books in a timely manner.

The interviewees noted how their organisations struggled with common challenges, including:

• Increased concern over lack of in-depth capabilities and integration with third-party solutions.

• Lack of visibility, data accuracy, and automation hindered growth.

• Increasing challenges with audit reporting, due diligence, and investor scrutiny.

KEY OUTCOMES

CFO’s using Sage Intacct in their company say:

“Sage Intacct allowed us to have a market-moving advantage. We are making our customers’ lives more efficient and automating our processes. We’re doing it all because Intacct gave us the capabilities.”

— CFO, insurance

“Within two years, we went from a 31- to a 5-day close, and our audit was a nonevent. We just let the auditors go into the system and audit the system, and there was minimal impact on my team.”

CFO, marketing technology“Sage Intact enabled us to have better visibility into customer health, which led to increased revenue and savings by preventing loss of renewals and reducing churn.”

CFO, cloud and software services“There are some complicated things in GAAP rules that Sage Intacct handles very well. It reduces the amount of effort required from our team. I would have to hire another person or two to be able to calculate the revenue recognition.”

CFO, cloud and software services

Read more about Sage Intacct’s ongoing implementation costs and cash flow analysis in the full report The Total Economic Impact™ Of Sage Intacct which you can download below.